Alternative Money Systems

So much about money, its use, and nature remains unexamined, mysterious. For instance, a quick look at some of the most-cited papers on the subject:

- princeton.edu - i_theory.pdf (271 citations)

- jstor.org - 2549103.pdf (1014 citations)

- web.mit.edu - tmc.pdf (1588 citations)

- econstor.eu - vol05-no02-a2.pdf (25 citations)

- econpapers.repec.org - knapp1924.htm (817 citations)

- academic.oup.com - 1875312 (78 citations)

Human use of money almost seems to be the unwitting application of inborn, default, natural, or instinctual human behaviors.

There’s only one known human culture that didn't develop some kind of number system. They're also only one of a few that didn't develop some kind of money system. (The Incas are also famous for not using a money-based bartering system.) Super cool!

But this is very strange given the incredibly important and central role that money plays in our lives!

Below, I describe a few systems I've managed to come up with!

Earlier Comments

Previously, I discussed:

- How two notions of value are interrelated and major problems within the concept of monetary value, pricing inefficiencies, and the likelihood that many sources of value (in both senses) are not tracked by the economy (which is worse than inefficiency - e.g. - waste requires something being evaluated as economically valuable in the first place then going unused or overused - in this case it’s something valuable that’s not being evaluated or used economically period).

- Formal Mereology - a theory of parts and wholes that dispenses with the idea of sets and numbers.

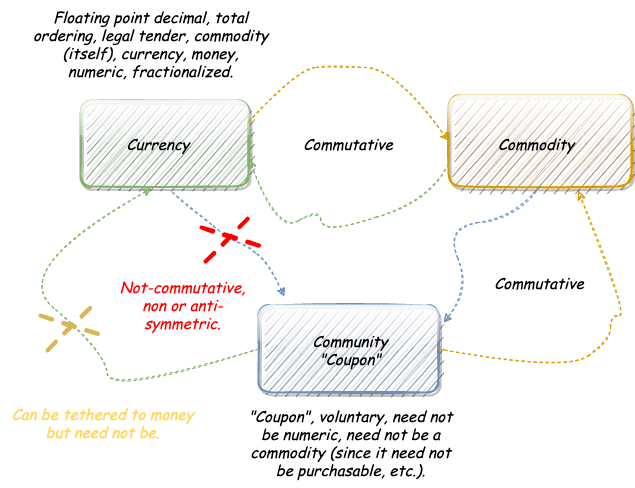

- Outlined a sketch of an idea implementing the popular concept of a community currency.

- Previously, I outlined what I understand to be the first deliberate non-numeric form of money by combining mereology with the idea of a transaction.

Note: there were probably early predecessor systems that were not strictly numeric (decimals and fractions had not been invented yet) that were monetary in some sense (use of shells for barter). These are probably more accurately described as barter systems characterized by a dominant commodity (gold, seashells, pebbles, etc.) that incidentally were monetary and/or non-numeric.

Anyway, the idea is bewildering at first - we immediately identify money systems with the decimals, floating point numbers precision two or three, the reals, etc. and the idea of a non-numeric monetary system is alien, novel.

Note: to my knowledge there has never been an academic published paper describing number-free, numberless, non-numeric money.

Wouldn't it be a terribly bitter irony if all of these intractable, sometimes violent, divisive political and economic debates over the ages (mercantilism, taxation, capitalism, socialism, etc.) all were the result of unexamined dogmas about the nature of money?

Money and Currency

Currency and money here will be treated as mostly interchangeable concepts (though there are some slight nuances in meaning within the economics literature):

- A store of value.

- A medium of exchange.

- A unit of account.

- An index of value.

I will add the following:

- A selected (gold, silver, seashells, etc.) or artificially constructed (the 1792 Coinage Act) commodity.

- Characterized by part-whole relations, total orderings.

- Characterized by floating point numbers of varying precision.

The above three points have not been discussed very much if at all in the literature. To me, that suggests that certain implicit assumptions about the concept of money are doing a lot of the "real work" in those theories.

For example, without assumptions about numbering (and therefore total orderings), money as it's currently legislated loses almost all of its coherence.

Non-Numeric Money

One way of doing this involves supplementing the axioms (of a suitable formulation of mereology) with the transactional valuation operator V .

- Numbers are replaced with functions expressing transactions between participants.

- Functions are time-indexed or asynchronous.

- Functions are open (not yet executed with an unknown recipient) or they are closed.

- Functions can be divided according to mereology or part-whole relations rather than arithmetic ones. A calculus exists for determining precisely when transactions "sum" to another.

We can, for instance, define the equivalence of the value of transactions in the following way:

- V(PPₐ ∧ PPₓ ∧ PPₑ) = V(PPᵥ)

- V(PPₐ) = V(PPₓ)

- (PPₐ ∧ PPₓ ≡ PPₑ) → V(PPₐ ∧ PPₓ) = V(PPₑ)

Note: Above PP stands for Proper Part and the subscripts individuate them (they can be letters, numbers or whatever).

This would "knock out" the implicitly assumed dogma 7 (from the preceding section Non-Numeric Money):

- [Money] characterized by floating point numbers of varying precision.

Note: Non-numeric means that the pricing mechanism is not number-based - see: Fallacy of Overnaming - whether numbers are used to individuate parts (which is properly called mapping a set to an index).

The core idea is that prices and transactions would not be listed using numbers. With the aid of digital technology, automatically inferring what items would be required to correctly and fairly execute an exchange would be possible in theory and in practice.

Dual Account

This system identifies a particular currency with two components: positive credits and negative debts:

- Positive credits: can be spent in certain scenarios.

- Negative debts: are kept in separate unit of account are must be repaid in certain scenarios before positive credits can be spent.

Most banks and financial institutions keep credits, balances, and obligations through double-entry accounting (but using a single currency component) which can be confusing and complicated. Such systems are highly dependent on time, availability, etc. The concept proposed here breaks the currency itself into two independent pieces and then stipulates how these two parts work together.

Here, a dual account currency is envisioned as being made of two components - two sides of the same coin (both literally and figuratively). Here, money isn't just broken into smaller units (quarters, pennies, etc.) but also into distinct parts that work together to establish the overall value of an account (this being an account-centric approach rather than a unit-centric one).

Suppose person A has the following accounts for this single Dual Account currency:

| Positive | Negative |

|---|---|

| 3 | -2 |

We can specify several different (and non-exclusive) scenarios defining how these accounts can be used:

- All 2 negative debts must be repaid before any positive accounts can be used.

- Negative debts can be transacted and sold - when they are sold they are exchanged for positive credits (with a time-dependent mechanism requiring some exchange of positive credits at some future date, say). In this case, negative debts would be time-dependent currency components.

- The total value of A holdings could be 3, 1, 5, etc. depending on how the system was specified and enforced.

- Positive credits can be spent without concern for negative debts but negative debts must be repaid.

- The sum of all positive credits and negative debts at any time must be positive for any spending by A.

Community Currency Coupon

I previously outlined a sketch of an idea implementing the popular concept of a community currency.

- Here, a coupon is issued.

- The coupon is universally and voluntarily accepted by all businesses within a community (and hence, not legal tender).

- It can be exchanged for goods and services like any legal tender (but is itself non-monetary meaning here that no money is transacted), redeemable into a bartered good or service, and voluntarily accepted (e.g. - a coupon).

- It can be created and issued to assist the less fortunate, subsidize business, etc. at no actual monetary cost (meaning there's no necessary exchange of money per se, just the bartered goods - goods that might be priced in some monetary term but for which no money supply is impacted upon such a transaction - that's the very objective here!).

The system above would likely have an inflationary impact since it operates in a manner akin to printing money.

The system above is not welfare and involves no taxation, monetary expenditure (during the exchange of goods), etc. Even the printing of money or upkeep of the system need not require monetary expenditure.

Suppose though it's decided to tether the coupon to something more monetarily-grounded (including money itself). If we supplement the four conditions above with the following, it might lose the inflationary footprint that would likely result from the above:

- A time-dependent mechanism that constrains the time-frame in which the coupons can be exchanged.

- For example, each coupon might have every "change-of-hands" tracked and incremented by one. The coupon can be spent only once every X-many days for each change of hands:

a. Coupon C can be exchanged once in 30 days for its first transaction.

b. Coupon C can be exchanged once in 90 days for its second transaction.

c. Coupon C can be exchanged once in 210 days for its third transaction.

So, the more times the coupons are exchanged, the greater the "cool-down" period becomes until their next exchange.

If it's true that the primary negative effects of inflation stem from more money being spent (thereby increasing demand, reducing supply, etc. and increasing prices), then a cool-down mechanic may help to mitigate run-away prices whilst simultaneously allowing for many basic needs, services, and other critical parts of government and public infrastructure to be paid for non-monetarily.

Are there other ways to support such a system? I think so.

Another way might involve creating a tradable control commodity that's pegged to a coupon. In this case the coupon can be transacted into dollars or bought and sold (like any other) once the tradable control commodity is able to be traded:

- Every coupon C is instead paired with a control commodity.

- C behaves just according to the original four conditions above with the added condition that it may be exchanged like legal tender (bought and sold into money) at some future time.

- The future time that the coupon can be exchanged is defined by the control commodity which "unlocks" after a set time.

In this scenario, people are rewarded for accepting the coupon since the government creates a control commodity to back the value of the coupon.

The control commodity can be pegged to some equity with intrinsic value (so that the value of the control commodity increases over time) encouraging saving after the first transaction (which might increase monetary value without some of the inflationary effects above).

Differences

A table depicting the differences between several similar concepts:

| Cryptocurrencies | Welfare | Money | Coupon | |

|---|---|---|---|---|

| Is money required for use? | Yes, to buy them. | Yes, to fund it. | Yes. | No. |

| Is it digitized? | Yes. | Mostly not. | Mostly not. | Can be. |

| Legal tender, fiat, or sovereign issued (though not necessarily all three)? | Overwhelmingly not but with a few counter-examples. | Yes. | Yes. | Yes. |

| Voluntary acceptance? | Yes. | No. | No. | Yes. |

- Comparing Value

- Toward Gift Economics #1

- Toward Gift Economics #2

- Toward Gift Economics #3

- Alternative Money Systems

- Community Currencies

post: 5/7/2020

update: 7/19/2020

update: 9/26/2021